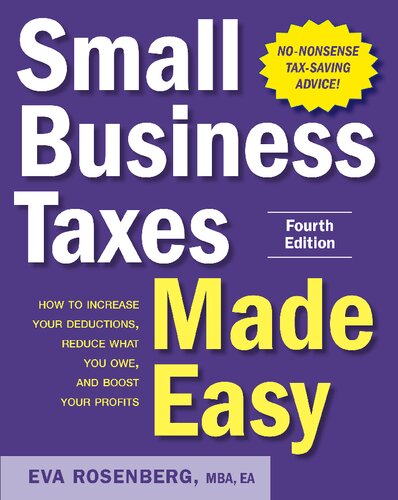

Small business taxes made easy : how to increase your deductions, reduce what you owe, and boost your profits – eBook PDF

$50.00 Original price was: $50.00.$35.00Current price is: $35.00.

Small business taxes made easy : how to increase your deductions, reduce what you owe, and boost your profits – Ebook PDF

Small business taxes made easy : how to increase your deductions, reduce what you owe, and boost your profits – Ebook PDF Instant Delivery – ISBN(s): 9781260468199,1260468194

Product details:

- ISBN-10 : 1260468186

- ISBN-13 : 978-1260468182

- Author: Eva Rosenberg

Discover how to increase your deductions, reduce what you owe, boost your profits, and build a dynasty

As if doing your business taxes weren’t complicated enough, you now have the Tax Cuts and Jobs Act to contend with. While this major overhaul throws a monkey wrench into the works, it provides unprecedented opportunities to keep even more of what you earn―if you’re up to speed on what the new law means and how to navigate it.

Small Business Taxes Made Easy has been fully updated to provide the knowledge, insights, and tools your business need to get ahead of the curve this tax season. You’ll learn everything you need to know for:

- Saving money on taxes and boosting your profits

- Building an increasingly profitable business, with the right advisory team

- Navigating the complex tax maze without losing the bank

- Setting up a business plan following the new tax guidelines to minimize tax payout

Table contents:

1 SMALL BUSINESS CHECKLIST

2 BUSINESS PLANS YOU KNOW AND TRUST

3 ENTITIES: SELECTING YOUR BUSINESS STRUCTURE

4 RECORD KEEPING

5 INCOME

6 COMMON DEDUCTIONS

7 OFFICE IN HOME

8 VEHICLES: EVERYONE’S FAVORITE DEDUCTION

9 EMPLOYEES AND INDEPENDENT CONTRACTORS

10 OWNERS’ FRINGE BENEFITS, RETIREMENT, AND TAX

DEFERMENT

11 ESTIMATED PAYMENTS

12 SPECIAL CONSIDERATIONS FOR ONLINE BUSINESSES—

AND BUSINESSES THAT SELL ACROSS STATE LINES

13 TAX NOTICES, AUDITS, AND COLLECTION NOTES

Epilogue: Some Final Words of Advice—and Resources to Rely On

Index

People also search:

what documents are needed for small business taxes

small business taxes what do i need

starting a small business taxes

easiest way to do small business taxes

small business made no money taxes

taxes made easy

how to do taxes as a small business owner

taxes small business