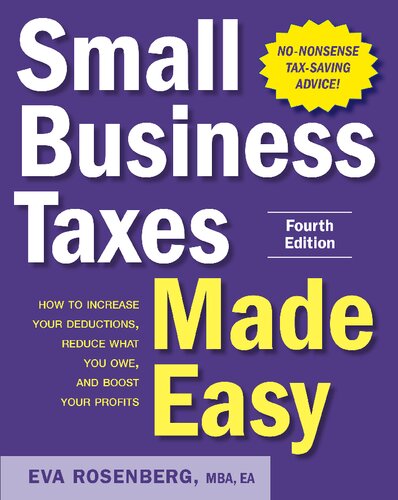

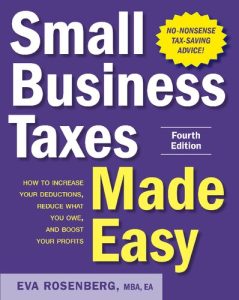

Small Business Taxes Made Easy, Fourth Edition Rosenberg – eBook PDF

$50.00 Original price was: $50.00.$35.00Current price is: $35.00.

Small Business Taxes Made Easy, Fourth Edition – Ebook PDF

Small Business Taxes Made Easy, Fourth Edition – Ebook PDF Instant Delivery – ISBN(s): 9781260468182,1260468186

Product details:

- ISBN-10 : 1260468186

- ISBN-13 : 978-1260468182

- Author: Eva Rosenberg,MBA

As if doing your business taxes weren’t complicated enough, you now have the Tax Cuts and Jobs Act to contend with. While this major overhaul throws a monkey wrench into the works, it provides unprecedented opportunities to keep even more of what you earn―if you’re up to speed on what the new law means and how to navigate it.

Small Business Taxes Made Easy has been fully updated to provide the knowledge, insights, and tools your business need to get ahead of the curve this tax season. You’ll learn everything you need to know for:

- Saving money on taxes and boosting your profits

- Building an increasingly profitable business, with the right advisory team

Table contents:

1 SMALL BUSINESS CHECKLIST

Three Indicators Will Predict the Success of the Business

So What Do You Need to Do?

The Checklist in To-Do Order

Resources

2 BUSINESS PLANS YOU KNOW AND TRUST

Create a Business Plan

Why You Need a Business Plan

Real Business—Planned Losses

General Benefits

The Fine Line Between Success and Failure

Exit Plans for Fun and Profit

Let’s Not Fail Due to Success

Knowing What to Do—When

Outline of a Plan

Rebalancing Your Business Plan for Tax Consequences

Business Plan Books and Resources

Resources

3 ENTITIES: SELECTING YOUR BUSINESS STRUCTURE

Decisions, Decisions, Decisions

What Do You Want to Be When You Grow Up?

An Overview of Certain Tax Considerations Related to Entities

Major Issues Related to Entities

Entities, in All Their Glory

A Brief Word About Nevada, Delaware, and Wyoming

Corporations

What About Nonprofits?

Entities We’re Not Discussing

All the Highlights in One Place

Your Big Decision

Resources

4 RECORD KEEPING

Keeping Records Is a Pain

Types of Accounting Systems

Doing It by Hand

The IRS Says It All

Fiscal Year

Accounting Styles

Records You Must Keep

How Long Should You Keep Records?

Glossary of Bookkeeping Terms

Resources

5 INCOME

Money In, Money Out, Wave Your Hands All About

A Capital Idea

What Is Income?

Timing of Income

A Brief Explanation About “Accrual Basis”

Sales Taxes Received—Are They Your Money?

Income Rarely Reported

The IRS Has a Cash Audit Guide

Some 1099s Your Business Receives

So What the Heck Is Income?

Resources

6 COMMON DEDUCTIONS

Rule of Thumb

Universally Deductible

It’s All About You

Mixed-Use Assets

Depreciation

More Deductions Than You Can Imagine

Resources

7 OFFICE IN HOME

The Song Is Right! Let’s Stay Home

It’s a Red Flag; It’s Just Asking for an Audit

Frustrating Change to the Law Affecting Employees

An Attractive Change to the Law Affecting Homeowners Only

Simplify, Simplify

Inner Space

Two Critical Reminders

Prove It, Baby!

What Are Office-in-Home Expenses?

When You Can’t Use Office-in-Home Deductions

Evaluate Your Options

A Final Note—and a Final Story

Resources

People also search:

small business taxes made easy

small business taxes for dummies pdf

small business taxes for dummies

taxes made easy

filing small business taxes for the first time

year end taxes for small business