(Original PDF) Stochastic Methods in Asset Pricing

$50.00 Original price was: $50.00.$35.00Current price is: $35.00.

(Original PDF) Stochastic Methods in Asset Pricing – Instant Download

(Original PDF) Stochastic Methods in Asset Pricing – Digital Ebook – Instant Delivery Download

Product details:

- ISBN-10 : 9780262036559

- ISBN-13 : 978-0262036559

- Author: Andrew Lyasoff

This book presents a self-contained, comprehensive, and yet concise and condensed overview of the theory and methods of probability, integration, stochastic processes, optimal control, and their connections to the principles of asset pricing. The book is broader in scope than other introductory-level graduate texts on the subject, requires fewer prerequisites, and covers the relevant material at greater depth, mainly without rigorous technical proofs. The book brings to an introductory level certain concepts and topics that are usually found in advanced research monographs on stochastic processes and asset pricing, and it attempts to establish greater clarity on the connections between these two fields.

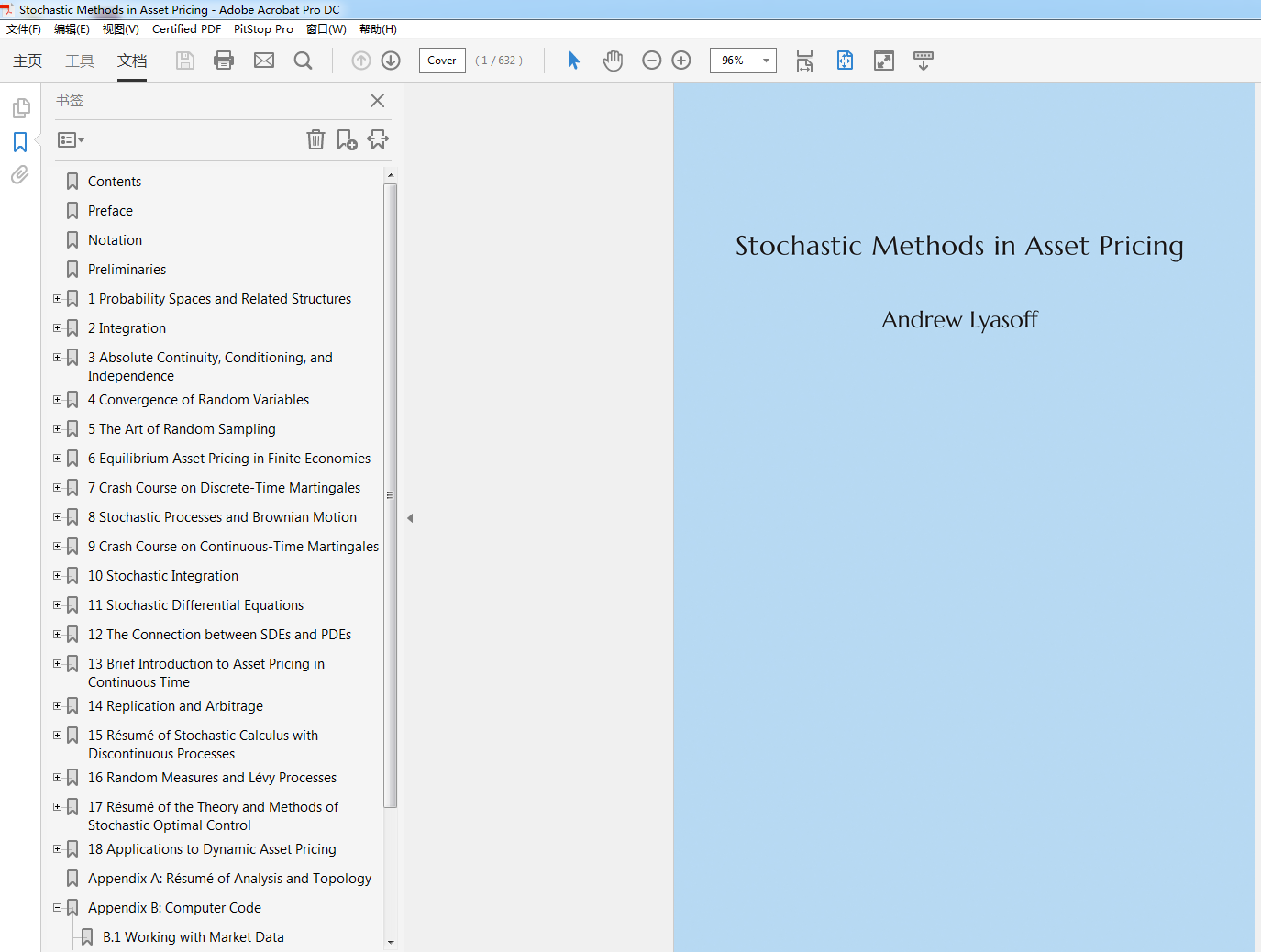

Table contents:

1. Probability Spaces and Related Structures 1

2. Integration 35

3. Absolute Continuity, Conditioning, and Independence 69

4. Convergence of Random Variables 97

5. The Art of Random Sampling 113

6. Equilibrium Asset Pricing in Finita Economies 123

7. Crash Course on Diserete-Time Martingales 161

8. Stochastic Processes and Brownian Motion 175

9. Crash Course on Continuous-Time Martingales 221

10. Stochastic Integration 257

11. Stochastic Differential Equations 295

12. The Connection between SDEs and PDEs 325

13. Brief Introduction to Assel Pricing in Continuous Time 337

14. Replication and Arbitrage 357

15. Resume of Stochastic Calculus with Discontinuous Processes 397

16. Random Measures and Levy Processes 425

17. Resume of the Theory and Methods of Stochastic Optimal Control 463

18. Applications to Dynamic Asset Pricing 481

People also search:

stochastic methods in asset pricing

stochastic methods in finance

what are stochastic methods

stochastic estimating methods

a stochastic approximation method

You may also like…

Business & Economics - Investing