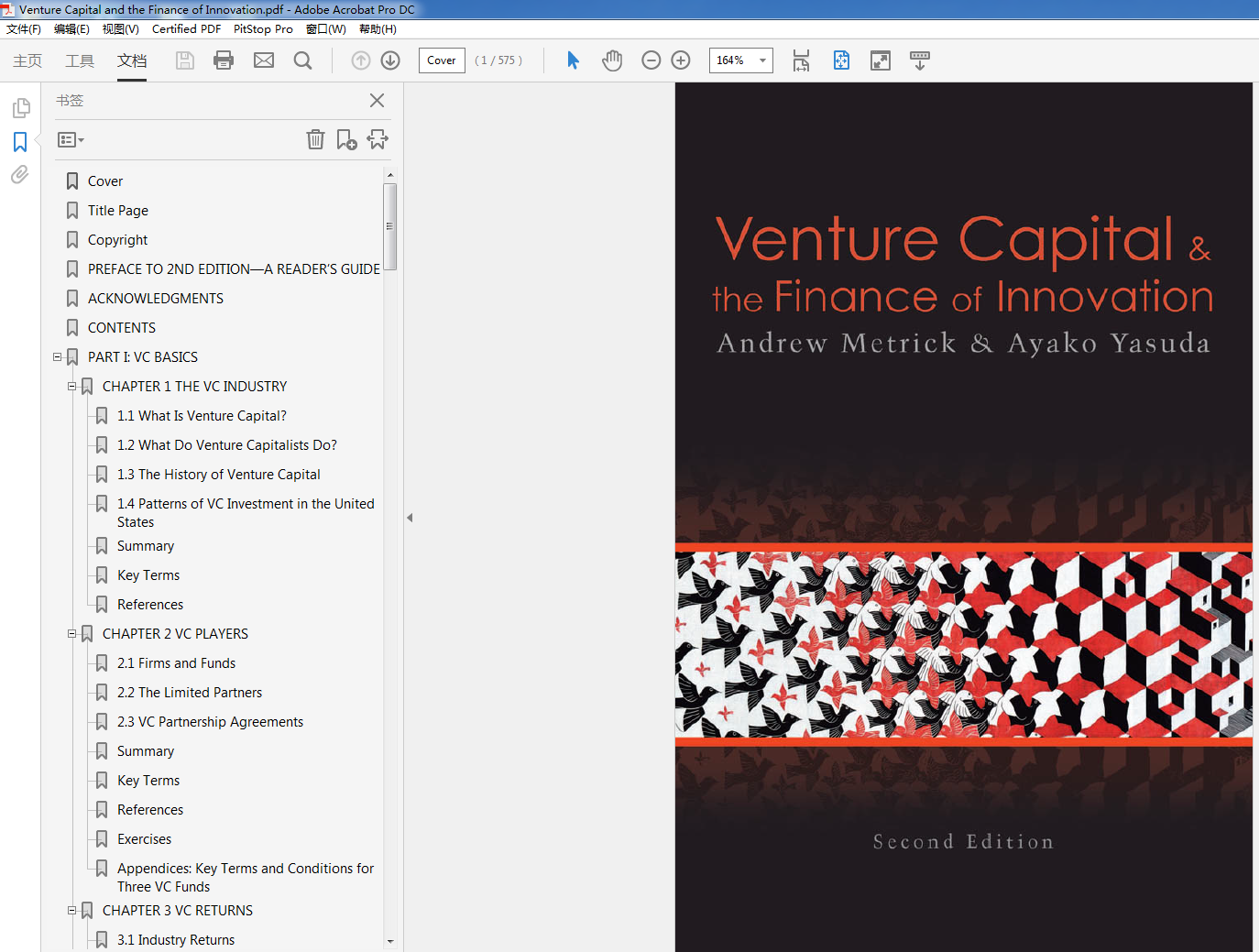

(Original PDF) Venture Capital and the Finance of Innovation, 2nd Edition

$50.00 Original price was: $50.00.$35.00Current price is: $35.00.

(Original PDF) Venture Capital and the Finance of Innovation, 2nd Edition – Instant Download

(Original PDF) Venture Capital and the Finance of Innovation 2nd Edition – Digital Ebook – Instant Delivery Download

Product details:

- ISBN-10 : 0470454709

- ISBN-13 : 978-0470454701

- Author: Andrew Metrick, Ayako Yasuda

In Venture Capital and the Finance of Innovation, future and current venture capitalists will find a useful guide to the principles of finance and the financial models that underlie venture capital decisions. Assuming no knowledge beyond concepts covered in first-year MBA course, the text serves as an innovative model for the valuation of start ups, and will familiarise you with the relationship between risk and return in venture capital, historical statistics on the performance of venture capital investments, total and partial valuation—and more.

Table contents:

1 The VC Industry

2 VC Players

3 VC Returns

4 The Cost of Capital For VC

5 The Best VCs

6 VC Around The World

7 The Analysis of VC Investments

8 Term Sheets

9 Preferred Stock

10 The VC Method

11 DCF Analysis of Growth Companies

12 Comparables Analysis

13 Option Pricing

14 The Valuation of Preferred Stock

15 Later-Round Investments

16 Participating Convertible Preferred Stock

17 Implied Valuation

18 Complex Structures

19 R&D Finance

20 Monte Carlo Simulation

21 Real Options

22 Binomial Trees

23 Game Theory

24 R&D Valuation

People also search:

venture capital in europe and the financing of innovative companies

venture finance definition

venture capital finance jobs

later stage financing of venture capital

You may also like…

Business

(eBook PDF) McKnight, Paterson, & Zakrzewski on the Law of International Finance 2nd Edition

Business

(eBook PDF) Entrepreneurial Finance: Venture Capital, Deal Structure & Valuation, Second Edition